E-commerce in Switzerland: a complete guide to dominate the market

The evolution of Switzerland's e-commerce market in the last years makes it a great opportunity for online businesses aiming to expand their reach in the Alpine country.

In this article, we will help you understand various aspects of Switzerland's e-commerce landscape, including market size, consumer behavior, leading platforms, logistics challenges, and emerging trends, providing a comprehensive overview for businesses looking to tap into this lucrative market.

The digital habits of Swiss consumers

With a population of almost 9 million inhabitants, Switzerland is, along with Finland, the European country with the highest percentage of its population connected to the internet; 99.3% of Swiss people are actively online.

Not only that, but e-commerce penetration is very high: 90% of people between the ages of 16 and 65 have ever made an online purchase, according to data collected by Netcomm Suisse, the Swiss e-commerce association.

Another point that makes Switzerland attractive is its purchasing power. With an average per capita income of €96,050 per year, the Swiss rank third in the world according to the IMF (International Monetary Fund).

Swiss were just behind Luxembourg (€118,770) and Ireland (€96,290) and closely followed by Singapore (€82,244) and Norway (€80,970) at the end of 2023.

Regarding social networks, Switzerland has 7.29 million users. WhatsApp (86%) is the most used platform, followed by Instagram (65.6%), while Google.ch is the most popular search engine (85%).

The Swiss e-commerce market

With an impressive 99.3% internet penetration rate and such a strong purchasing power (an average per capital income ranking third globally), the Swiss market is potentially a huge opportunity for foreign online retailers.

Leading the global retail sales growth until 2021

During 2021, the last full year for which official data is available, e-commerce exceeded €14.4 billion for the first time, experiencing a growth of 9.9%, obviously well below 2020, the year of the pandemic, where online growth reached 27%.

An interesting fact is to compare the growth of traditional or physical retail versus e-commerce in the years around the Covid-19 pandemic.

During 2021, traditional retail grew by 2.2% (90 billion Swiss Francs) compared to 2020, but if we look at 2016, the figure has barely changed by 2.6% (from 87 billion Swiss Francs to 90 billion Swiss Francs).

For its part, e-commerce has been the main recipient of total retail sales growth, with an increase of 85%. In 2016, its turnover amounted to 7.8 billion Swiss Francs, while this amount will almost double (+85%) by 2021 (14.4 billion Swiss Francs).

Commerce Report Switzerland 2022 | Source: Datatrans

Highly dispersed e-commerce market share

In contrast to other markets where only a few players have the largest market share, e-commerce in Switzerland offers more opportunities to a larger number of players.

For example, and always with data at the end of 2021, the top 30 e-commerce in Switzerland have a combined share of around 64%; they also experienced higher growth than the market average: the top 30 online retailers increased their sales by 14%, while the average for the year was 9.9%.

Zalando, Digitec and Amazon.de are in the Top 3, a ranking that has not changed since 2016, showing the hegemony of these brands.

Commerce Report Switzerland 2022 | Source: Datatrans

What do the Swiss buy online

Understanding the purchasing habits and preferred platforms of Swiss consumers is crucial for businesses looking to succeed in this lucrative market:

- Consumer electronics leads online sales in Switzerland, generating 27.3% of total e-commerce revenues, according to data from EcommerceDB.

- Fashion, with a 23.7% share.

- Hobby and leisure sectors account for 15.1% of revenues.

- Food with 14.0%.

- Furniture and household goods contribute 9.3%, while,

- Care products account for 7.1%.

- DIY closes the list with the remaining 3.5%.

Where do the Swiss buy online

Now that we know which are the stronger sectors in the Swiss online market, let’s see which are the stronger players for them:

- Digitec.ch: it is Switzerland's largest online marketplace, with net e-commerce sales of 1,151.70 million euros. It specialises in electronics and offers a wide range of products, including computers, smartphones, cameras, video game consoles and televisions, among others.

- Zalando.ch: it is the leading player in terms of turnover in Switzerland. With sales of 1,115 million euros.

- Galaxus.ch: Galaxus.ch has net e-commerce sales of 672 million euros. It is a generalist platform that sells products in various categories, such as home and housing, sports and leisure, toys and games, books and media, etc. Galaxus.ch is owned by the same company as Digitec.ch.

- Brack.ch: with net e-commerce sales of 525 million euros. It is another generalist platform that sells products in various categories, such as electronics, office supplies, household goods, gardening tools, pet supplies, etc. Brack.ch is part of the Competec group, which also operates other online shops such as Alltron.ch, PCP.ch and B2B.ch.

- Amazon.de: Amazon does not have a Swiss domain as such, but the Swiss buy via the German platform, with net sales of 737 million euros.

- Ricardo.ch: has net e-commerce sales of 295 million euros. It is a C2C platform that allows users to buy and sell new and used products, such as clothes, jewellery, art, antiques, cars and much more. Ricardo.ch is the most popular marketplace in Switzerland, with 80% of consumers considering it their favourite platform.

- Microspot.ch: with sales reaching 258 million euros, Microspot is an electronics specialist offering a wide range of products such as laptops, tablets, printers, cameras, headphones, etc. Microspot.ch is owned by Coop, one of Switzerland's largest retail groups, and benefits from its network of physical shops, where customers can pick up or return their orders.

- Manor.ch: is the largest chain of supermarkets and department stores in the country, with a total of 60 outlets. Its online turnover amounts to 221 million euros. It sells products in various categories, such as fashion, beauty, home, children and food.

- Nespresso.com: one of Switzerland's top online success stories is Nespresso, with net e-commerce sales of 184 million euros.

- IKEA.com: Ikea has its fans in Switzerland, with online sales exceeding 165 million euros.

- Leshop.ch: is the leading online supermarket in Switzerland, with sales of 147.5 million euros. It belongs to the Migros group, one of the country's leading retailers with 600 physical outlets. Leshop.ch customers can shop for a wide range of products, including fresh food, beverages, household goods, pets and more.

- Farmy.ch: Sustainability is a major concern in Switzerland and one of the country's big players is Farmy.ch, an e-commerce specialised in organic, local and artisanal products, such as fruit, vegetables, meat, cheese, bread and much more. Farmy.ch works directly with more than 1,000 farmers and producers and delivers fresh, quality products to your door. Its turnover exceeds 110.5 million euros.

- Ochsner-sport.ch: It is the online shop of the Ochsner Sport group, Switzerland's largest sports retailer, with more than 80 shops nationwide. Ochsner-sport.ch sells 92.15 million euros online.

How do the Swiss pay

Each payment option attracts respectively one third of all Swiss consumers. Only 16% of Swiss shoppers prefer to use e-wallets such as PayPal, and debit cards are used by only 7%.

Finally, with regard to payment methods, if you have an online shop in Switzerland, make sure you offer at least one payment option for credit card and invoice.

The Swiss e-commerce market paradigm shift: losing the tailwind in 2022-2024

As in other European countries where more recent data is available, the online channel has suffered a significant decline between 2022 and 2024 to pre-pandemic ‘normal’ levels.

In other words, the tailwind from the pandemic phase is no longer accelerating the pace of growth, although consumer behaviour has changed, shifting towards intangibles.

One of the main reasons for this is the end of restrictions, which again favours spending on travel and leisure, which suffered greatly during the lockdown years.

Consequently, the savings needed to meet the cost of these intangible items have led to a direct decrease in the purchase of smaller consumer goods such as clothing and electronics.

There is also a counter-trend to digital experiences. While Netflix is plummeting, more physical books are being bought, as are physical games, even for adults; while home electronics are weakening, sporting goods and bicycles continue to perform very well.

Commerce Report Switzerland 2022 | Source: Datatrans

Current Swiss consumers trend: Sustainability

One of the main consumer trends to watch out for in Switzerland is sustainability, the demand for which is booming.

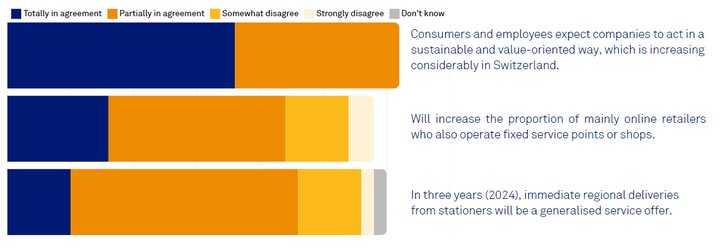

In the Commerce Report Switzerland 2022, 100% of respondents said that both consumers and employees expect corporations to behave in a sustainable manner.

But it should not be forgotten that sustainable products are often more expensive than conventional ones and therefore not a viable option for part of the population.

Sustainability, for example, is less of a concern in Poland than in Switzerland, in view of the lower purchasing power. But the less exceptional sustainability is, the smaller the price differences should be.

E-commerce logistics in Switzerland

When talking about logistics in Switzerland, it should not be forgotten that this country is not part of the European Union, adding complexity to cross-border tasks in e-commerce.

Logistics in Switzerland is efficient, ranking first in the postal ranking and with 99.9% which prefers home delivery service. However, e-commerce faces the challenge of high return rates of approximately 25%, which generates additional costs and environmental concerns.

The country's leading logistics operator is Swiss Post, the national postal service, which in 2023 delivered a total of 185 million parcels, 4.7% less than in 2022, mainly due to the tailwind that has stopped blowing since the Coronavirus. However, compared to the pre-pandemic year (2019), the growth experienced was 23.6%.

Barriers to online trade in Switzerland from other countries

Insofar as Switzerland does not belong to the EU, online sales to the country from other EU countries imply the application of border controls and tariffs for non-industrial goods, with special tariff incidence in the case of some agri-food products.

The customs issue has been the subject of political debate in Switzerland this year. The legislative amendment, approved by the National Council, could have important consequences for the delivery of parcels in Switzerland. Critics predict that the process will become slower, more complicated and more expensive.

In essence, the new law, which some Swiss politicians have described as a ‘monster’, provides that importers and exporters will be able to decide for themselves who is responsible for the customs clearance of parcels. They can either take care of it themselves or delegate this responsibility to consumers, with all the questions that this would entail.

Conclusion

Switzerland's e-commerce landscape presents a unique blend of opportunities and challenges for businesses looking to tap into this affluent and highly connected market. With a tech-savvy population, strong purchasing power, and a growing emphasis on sustainability, the Swiss market offers lucrative prospects for online retailers who can navigate the intricacies of cross-border logistics and adapt to evolving consumer preferences.

By understanding the digital habits, payment preferences, and key players in the market, businesses can strategically position themselves to succeed in this dynamic environment. Whether you're expanding into Switzerland or optimizing your existing operations, staying informed and agile will be key to thriving in this competitive space