Sports e-commerce: How online sales of sporting goods have grown in Europe

In recent years, the sporting goods category has seen a notable increase in online sales in Europe.

Driven by the growth of e-commerce, increased interest in health and wellness, and the impact of the COVID-19 pandemic, demand for sports products has increasingly migrated to digital platforms.

In this article, we look at the main trends behind this growth, based on up-to-date data highlighting the transformation of the sports market in Europe.

Characteristics of sporting goods

The sporting goods category in the European e-commerce market includes a wide variety of products and subcategories related to sports and physical activities

Some examples include:

Sportswear

Sports shoes

Sports equipment and accessories

Equipment for specific sports

Outdoor products

Sports supplements and nutrition

Electronic sports (eSports) goods

Sports technology (wearables)

These products are designed to improve sports practice, physical well-being, and meet the diverse needs of consumers who practice different sports.

Increase in online sales of sporting goods

Historically, sports have been a key part of European culture, and the sporting goods market is no exception. However, consumer behavior has changed dramatically in recent years.

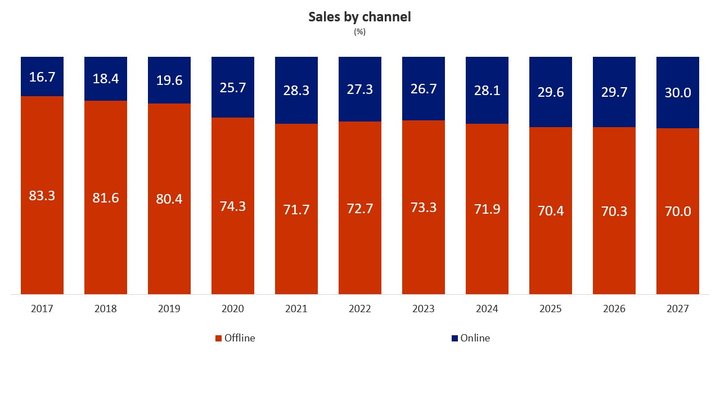

A study on the global distribution of online and offline sales of sports and outdoor products between 2017 and 2027 shows a sustained growth in the e-commerce market.

In 2017, 16.7% of sales were made online, while by 2024 this percentage is expected to reach 28.1%, representing an increase of 11.4%.

Furthermore, the sports market in Europe is projected to grow at a compound annual rate of 10.90% (CAGR 2022-2027), reaching a market volume of €436.90 million in 2027.

Key data for 2024

The sports equipment market in Europe is estimated to generate $28.5 billion.

Annual growth of 4.21% (CAGR 2024-2028) is forecast.

Income per person: $33.75 (€30.35) estimated in 2024.

By 2029, the market volume could reach $43.18 billion.

The influence of social networks on sports e-commerce

In addition to data, it's critical to look at what consumers perceive today.

In the social media age, we are constantly exposed to advertising, user-generated content (UGC), and influencers promoting their sport.

This has made sports a trend, especially among generation Z.

Social trading is also rapidly gaining traction.

The most recognised brands such as Nike, Adidas and Decathlon have invested heavily in digital strategies that use influencers and athletes to promote their products on platforms such as Instagram and YouTube.

Challenges and opportunities of the sports e-commerce market in Europe

Despite the remarkable growth in online sales of sporting goods, companies face several challenges:

- High online competition: With a large number of retailers competing for the attention of the same group of consumers.

- Complex logistics: Managing inventory and shipping can be complicated, especially in a market as large and diverse as Europe.

Nonetheless, the opportunities are significant. Brands that leverage trends such as personalisation and omnichannel shopping experiences will be better positioned to capture greater market share.

In addition, the integration of emerging technologies such as augmented reality and artificial intelligence will allow consumers to enjoy more engaging and personalised shopping experiences.

The future of sports within the European e-commerce market

In conclusion, the growth of sporting goods e-commerce in Europe continues to strengthen, driven by the combination of cultural, technological and economic factors.

Brands that invest in personalised digital experiences, capitalise on social media, and optimise their logistics operations will be in an advantageous position to capture consumers' attention and expand their share of this ever-evolving market.